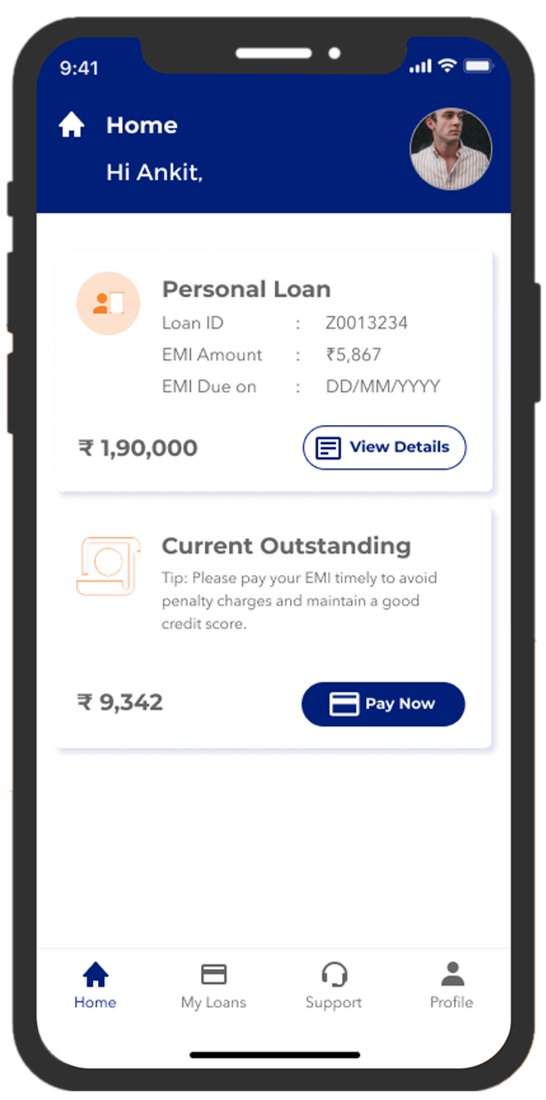

Getting a personal loan was never this easy

Get Instant Personal Loan up to ₹8 Lakhs. Enjoy the benefits from low credit score to affordable interest rates. Fulfill your dreams with Edelweiss Instant Loans easy approval with minimum documents required.

Eligibility & Documents Required for Instant Personal Loan

- Indian Citizen

- Age between 18 - 60 years

- Identity Proof (PAN)

- Address Proof (Aadhaar)

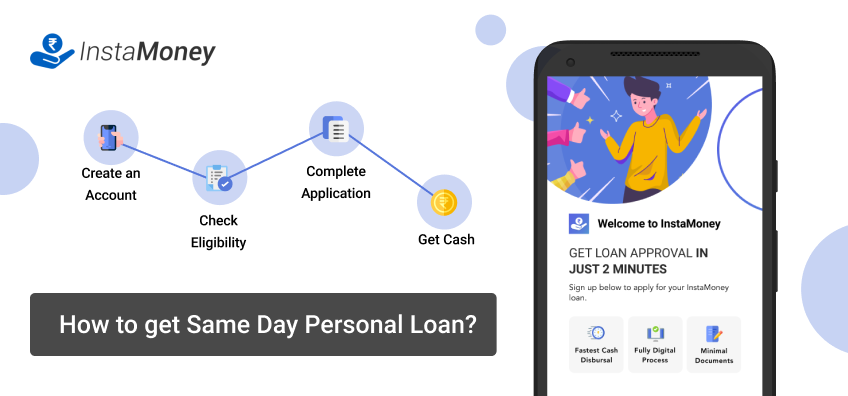

Steps to Apply for Instant Personal Loan

1. Download App

Install our app and tell us a little bit about yourself and complete KYC. In a few minutes, we will tell you if you qualify for Edelweiss Finance and your eligible credit limit.

2. Choose Loan Amount and Terms

Once you qualify, you can select your preferred loan amount and terms from the available options.

3. Get your money

Once your loan agreement is confirmed and the application procedure is complete, your money will be directly transferred to your bank account.

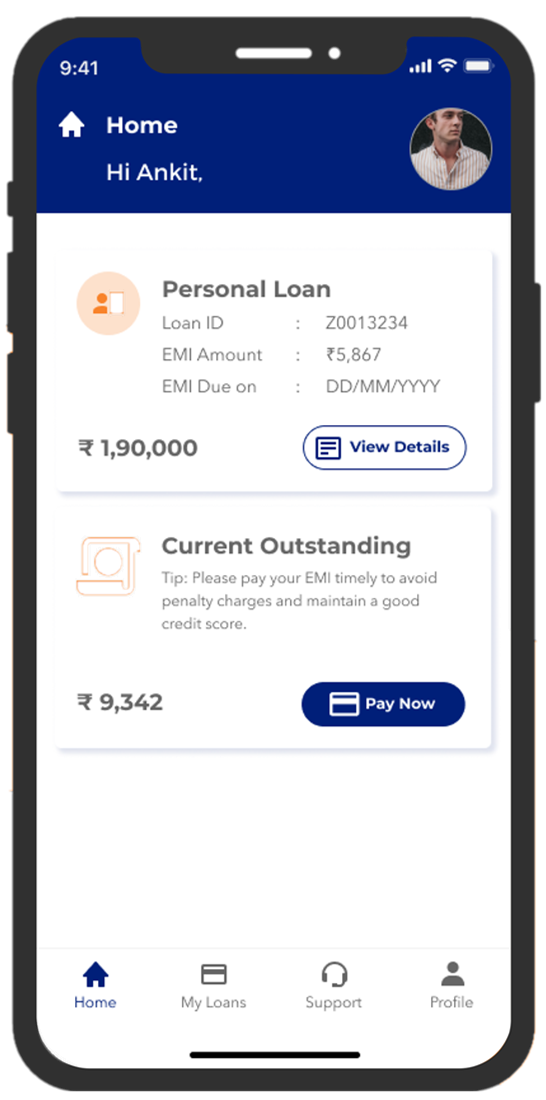

EMI Calculator

Calculate your personal loan EMI to plan you EMIs.

EMI Calculator

Monthly EMI

₹5935

Total Interest

₹212211

Total Amount: ₹712210.61

Loan Amount: ₹500000.00

Interest Rate: 7.50%

FAQ - Frequently Asked Questions

Get answers to your questions about our awesome app! Learn more and explore its features now.

1. What is Edelweiss Finance?

Edelweiss Finance is India’s app-based personal credit.

With the tap of a button, this app lets you borrow as little as Rs. 50,000 or as much as Rs. 8 lakhs depending on your credit limit. More importantly, you pay interest only on what you use.

2. Can I take the money in cash and spend it on whatever I want? How?

Yes. You can transfer money from your app to your bank account and use them as you wish to someone depending on your needs. The funds are yours.

3. Do I have to pay interest? Is it high?

You have to pay interest only on the funds you use. At the time of withdrawal, you can choose the terms of repayment, which can be anywhere between 3 months and 5 years. The repayment tenure you choose will determine your EMIs.

The interest rate can be as low as 8.04% per year depending on the credit profile of the user.

4. Can I pre-close my loan?

Yes, you can. A loan foreclosure can only be requested after successful payment of 1st monthly EMI. Then there is no other fees.

5. Is it safe to apply for Edelweiss Finance online?

It is absolutely safe. All your sensitive information, which are personal or financial are encrypted through the Secure Socket Layer (SSL) protocol. We will not share your information with any marketing agencies or tele-callers who will call to sell you other products.

Our systems have been designed such that most of the steps are automated. Our IT systems are checked and approved by the IT and Data Security teams of our partner banks. We are legally compliant with all data privacy and IT security norms in India.

Read latest from blog

Stay in the know! Read our latest news from the blog

for up-to-date information.

10 Best Instant Loan Apps in India